引 言

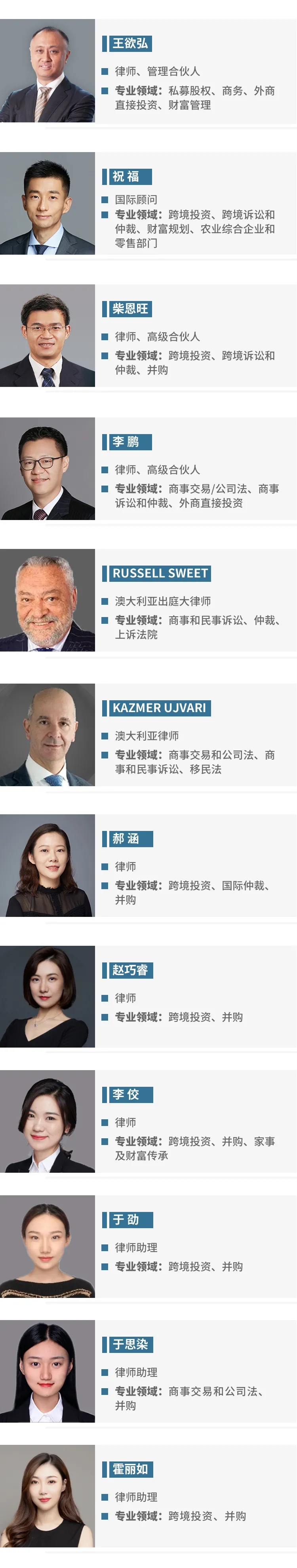

文康君益诚律师联盟处理过诸多涉及澳大利亚的业务,在此基础上联盟成立了澳洲业务团队,团队成员包括多位能以英语为熟练工作语言的中国律师以及澳大利亚注册律师,其中王欲弘律师在中澳法律、投资、贸易、移民等业务领域深耕多年。团队国际法律顾问祝福律师拥有澳洲律师牌照近十年,作为在澳大利亚长大的华人,熟悉中澳两国文化,处理了大量中澳跨境法律事务,经验丰富。

澳洲业务团队可为文康君益诚联盟客户提供与中国-澳大利亚有关的投资、贸易、移民、跨国婚姻、诉讼等全方位、一站式的商业和法律服务。

有关家庭信托的问题

受益人

信托必须有明确的受益人。全权信托将有一般类别的全权信托受益人。

通常,全权信托指定的特定受益人群体为 “首要”、“第二”和“第三”受益人。

(a)通常来说,首要受益人将是信托的初始控制人。

(b)第二受益人将通常是首要受益人的子女及其他家庭成员。

(c)第三受益人通常是相关的公司、信托、慈善组织等。

受托人对每年如何分配信托的收入和资本有绝对的决定权。因此,受托人可以将一年的全部或部分收入和资本分配给首要受益人、第二受益人或第三受益人。

但是,如果没有决定如何分配收益,默认受益人(通常是首要受益人)将平均分配收益。

Beneficiaries

A trust must have identifiable beneficiaries. A discretionary trust will have a general class of discretionary beneficiaries.

It is usual to designate particular groupings of beneficiaries of discretionary trusts as ‘primary’, ‘secondary’ and ‘tertiary’ beneficiaries.

(a) Generally, the primary beneficiaries will be the parties who are the initial controllers of the trust.

(b) The secondary beneficiaries will usually be the children and other family members of the primary beneficiaries.

(c) Tertiary beneficiaries will generally be related companies, trusts, charitable organisations etc.

The trustee has an absolute discretion as to how income and capital of the trust is distributed on a year to year basis. Therefore, the trustee can distribute the whole or part of the income for a year and capital to any one of the primary, secondary or tertiary beneficiaries.

However, if there is no decision made as to how the income is to be distributed, the default beneficiaries (usually the primary beneficiaries) will share in the income equally.

与公司受托人有关的问题

信托空壳公司

文康-君益诚涉澳法律团队

无论您想在澳大利亚设立子公司还是收购澳大利亚公司股权或资产,文康-君益诚涉澳法律团队将为中国投资者提供最专业且全面的一站式服务。

团队介绍

专栏文章

-

婚姻家事财富管理

配偶打赏主播的钱款能否返还?

专业解读2024-10-10 -

婚姻家事财富管理

“父债子偿”的实务探究

专业解读2024-05-06 -

婚姻家事财富管理

离婚协议中约定转化夫妻财产协议条款效力问题探析

专业解读2024-04-29 -

保全与执行

夫妻共同财产及夫妻共同债务的认定与执行实务

本文旨在廓清执行夫妻共同财产案件中的迷雾,为债权人提供切实可行的诉讼和执行方法。2024-04-17 -

婚姻家事财富管理

公司股权代持在离婚案件中的认定路径

专业解读2024-04-02 -

婚姻家事财富管理

遗嘱是场景和情绪价值

专业解读2024-03-11 -

婚姻家事财富管理

最高法新规施行后,浅析彩礼返还二三事

笔者将结合最高法新规及涉彩礼纠纷典型案例进行详细解读。2024-02-28 -

婚姻家事财富管理

司法大数据视角下同居关系分割遗产问题探析——兼谈民法典第1131条的适用

专业解读2023-08-25