介绍

Introduction

在澳大利亚购买房产时,需要考虑一系列问题。在多数情况下,大部分问题对购房者而言都不是迫切的问题,然而,良好的决策通常是在对相关因素有全面了解的基础上做出的。

When purchasing a property in Australia, a matrix of issues is to be considered. In most circumstances most of these issues are not pressing issues for the purchaser, however, as it is often the case, good decisions are made based on comprehensive knowledge of factors relevant to the making of the decision.

虽然这些问题看似与高净值人士更具有关联性,但事实并非如此。它们与所有家庭和个人都相关,事实上,家庭财富的积累,无论是在某人的一生之中还是代际之间,都很有可能是从购买第一套家庭住宅开始的。如果处理得当,不仅有助于财富的积累,还有助于财富保值。

Although it may seem that these issues are more relevant to higher net-worth individuals, this is not necessarily the case. These are relevant to all families and individuals, in fact, the accumulation of family wealth, either within a lifetime or intergenerational, may very well start with the purchase of the first family home. If done correctly, this does not only aid in the accumulation of wealth, but also in its preservation.

这其中的一些问题包括:

财富保值和遗产规划

家庭因素

商业因素

税收问题

损耗利用率

印花税问题

家庭资产结构的财务灵活性(未来资产的评估)

显然,上述问题可以进一步划分为法律问题和税收问题。今天,我们将讨论法律问题以及如何利用法律手段做好财富保值。

Some of these issues are:

• Wealth preservation and estate planning

• Family considerations

• Commercial considerations

• Taxation issues

• Loss utilization

• Stamp duty issues

• Financial flexibility in family asset structure (assessing capital in the future)

Evidently, the above issues can be further separated in to legal and taxation issues. We will today speak about the legal issues and how this can be utilized for wealth preservation.

第一部分

PART 1. Differences in Purpose

购房者主要是出于两种目的,通常是居住(住宅)或投资(商业)。

Purchasers of property do so predominantly for 2 purposes, these are commonly to live in (residential) or for investment (commercial).

对于那些购买首套住房(家庭住宅)的人来说,最优先考虑的是家庭的需求(家庭因素)。重要的是,购房者将把大部分资金/资产投资在家庭住宅上,因此,尤其是对于一个年轻的家庭而言,这笔资产应该得到最大程度的保护。此外,更重要的是,这种房产通常是在贷款的帮助下购买的,并且该房产会被用作贷款担保的抵押物(例如按揭)。

For those who are purchasing a primary residence (the family home) the top priority are the needs of the family (family considerations). Importantly, it is the family home that the purchaser will invest the majority of their funds/capital into, as such, and especially for a young family, this asset should be protected the most. Additionally, and more importantly, this property is most often purchased with the assistance of a loan and the property is used as collateral to secure the loan (such as a mortgage).

因此,家庭生活需求方面的因素(例如大小、位置、价值和投资回报)是为整个家庭的财产保值,如果该房产是在年迈的父母名下,就可能会涉及到遗产的规划(从法律角度来看,无论所有者的年龄如何,遗产规划始终是相关的)。

As such, considerations ensuing the family’s living requirements (such as size, location, value and returns on investment) are those of wealth preservation for the entire family, and if this property is under the name of the elderly parents, then estate planning may be relevant (from a legal perspective estate planning is always relevant no matter the age of the owner).

如果有贷款,那么与财富保值相关的问题包括用以抵消与贷款服务风险相关的金融工具。必须考虑的因素包括子女的年龄、您与配偶的收入能力、家庭财务的灵活性、您与家人的健康状况等等。

If there is a loan, then issues relating to wealth preservation includes financial tools to offset the risks associated with servicing of the loan. What must be considered is the age of your children, the earning ability of your partner and yourself, the flexibility of your family’s finances, you and your family’s health amongst other issues.

从本质上讲,在考验期这些问题已经变得非常实际。问题是,如果家庭的主要收入来源不再能够产生收益,将会发生什么。

Essentially, and as it has become very real during these testing times, the question to be asked is what will happen if the main income earning in the household can no longer generate an income.

鉴于上述情况,从财富保值的角度来看,必须考虑的是:

1.有什么事情发生,我采取了何种保障措施;

2.如果我在经营一家企业,我该如何将我的家庭以及家庭财富与索赔隔绝。

Given the above, from a wealth preservation perspective, what must be considered is:

1. What safety nets have I put into place if something happens;

2. If I operate a business, how do I insulate my family and our family wealth from claims.

就保障措施而言,常用的工具可包括人寿保险、职业责任保险(如适用)、收入保险、财产保险、抵押贷款保险等。尽管这些工具似乎只属于“保险领域”,但都是与法律因素非常相关的。

In relation to the safety nets, common tools may involve life insurance, professional indemnity insurance (where applicable), income insurance, property insurance, mortgage insurance etc. Although these tools are seemingly exclusively in the “insurance sphere”, legal considerations are very relevant.

以人寿保险为例,如何向指定的受益人支付,以及这与您的遗嘱有何关联,可能会极大地影响到您所爱的人是否有能力保住家庭住房。

Taking life insurance as an example, how the named beneficiaries is to be paid and how this relates to your Will may impact greatly on the ability for your loved ones to keep the family home.

如果要为成年子女买房或帮助子女购买他们的第一套住房,这就涉及到家庭法律问题。父母应设法通过贷款协议(有担保或无担保)、抵押契据、信托结构等方式来保护家庭的财富。

If purchasing for an adult child or assisting a child to purchase their first home, then family law issues may be relevant. Parents should seek to preserve the family’s wealth through loan agreements (whether secured or unsecured), mortgage deeds, trust structures amongst others.

为了使家庭的财产与商业风险隔绝,需要仔细考虑为经营企业或购买投资房产而选择的商业结构。这种决策应是理性、谨慎的,尤其是在商业投资会招致商业风险的情况下。

In relation insulating the family’s assets from business risks, the business structure chosen for either the operation of a business or for the purchase of an investment property requires careful consideration. Such decisions should be made rationally and carefully, this is especially the case as a business investment will incur business risks.

不管我们希望与否,人生都充满了潜在的负债。您与其他各方的交易越多,与他人发生法律纠纷的可能性就越高,而这反过来可能会让您来之不易的资产面临风险。

Whether we like it or not, life is full of potential liabilities. The more dealings you have with other parties, the higher the probability you might run into legal disputes with others, which might, in turn, expose your hard-earned assets to risk.

设计资产的持有方式时,应考虑并最大程度地隔离这些潜在负债,例如,您可以考虑将您的宝贵资产“锁定”在一个实体中,如果您被起诉,债权人或破产管理人很难对您提出索赔。

Structuring how your assets are held need to take into account and quarantine these potential liabilities to the maximum extent possible, eg, you may consider ‘locking’ your valuable assets in an entity that is difficult for creditors or the trustee in bankruptcy to make a claim against you if you get sued.

一个简单的例子是,商业贷款可能需要董事或者家庭成员个人提供担保,顾名思义,这种担保形式直接将商业风险与家庭财产联系在一起。商业风险是非常真实的,而且比健康状况不佳或失去收入来源等个人风险发生得更频繁,因此,应获取相关法律建议,以适当地将此类风险与家庭隔绝。

One simple example is that business loans may require a personal guarantee from its directors or a family member, this form of guarantee, as the name suggests, directly links the business risks with your family’s assets. Business risks are very real and occur much more frequent than personal risks such as ill health or loss of income, as such legal advice should be obtained to properly insulate such risks from the family.

此外,最常见的情况是通过家庭财富购买投资性房产(商业或住宅),这是一项金融投资,具有内在的商业风险,根据所选结构的类型,可以适用法律手段降低此类风险。

Furthermore, the most common scenario for the purchase of an investment property (commercial or residential) is through the family’s wealth, this being a financial investment has inherent business risks, and depending on the type of structure chosen, there are legal tools available to greatly lessen this risk.

同样相关的是,家庭住宅有时候可能被用来获取更多的财富,例如用于家族企业资本投资的二次按揭。在这种情况下,您的家庭财富再次与您的商业风险直接相关。

Also relevant, the family home may at times be used for the acquisition of further wealth, such as a second mortgage taken to for capital investment into the family’s business. In such circumstances, your family’s wealth is once again directly linked to your business risks.

不幸的是,大多数人对于这些风险因素并不知情,而且大多数人只在这些风险成为迫切问题时才会予以关注。如果没有提前做好适当的规划,那么妥善保护家庭财富通常为时已晚。

Unfortunately, these risk factors are unbeknownst to most individuals, and most individuals only consider such risks when they become pressing concerns. Without the proper planning done ahead of time, it is often too late for the family’s wealth to be properly protected.

在这种情况下,家庭应该关注的是建立一种结构,使家庭的财富既可以得到保护,又可以与风险隔绝。

In these circumstances, what the family should be concerned about is setting up a structure whereby the family’s wealth can be both preserved and insulated from risks.

纳税是最常发生的事情之一。正如人们常说的,死亡和税收是无法避免的。无论是您本人,您的企业,您的投资,还是您的家庭成员,除了生日,最经常发生的年度事件就是纳税申报。如果以家庭财富保值为设计理念,把家庭作为一个整体来考虑,在增加家庭财富池方面可以取得令人难以置信的成就。简单地说,在10年内每年节省1万澳元相当于10万澳元。这笔钱可有多种用途,例如购买另一套投资性住房。

One of the most regularly occurring events is the payment of taxes. As it is most commonly said, death and tax are not avoidable. Whether it is you, your business, your investment, or your family members, the most reoccurring annual event, other than birthdays, is the lodgement of taxes. If designed with family wealth preservation and considering the family as a single unit, incredible achievements can be made in increasing the family wealth pool. To put simply, savings of A$10,000 per year over the course of 10 years equates to A$100,000. This sum can be used for a variety of purposes such as the purchase of another investment home.

第二部分 请见下期

PART 2 for next week

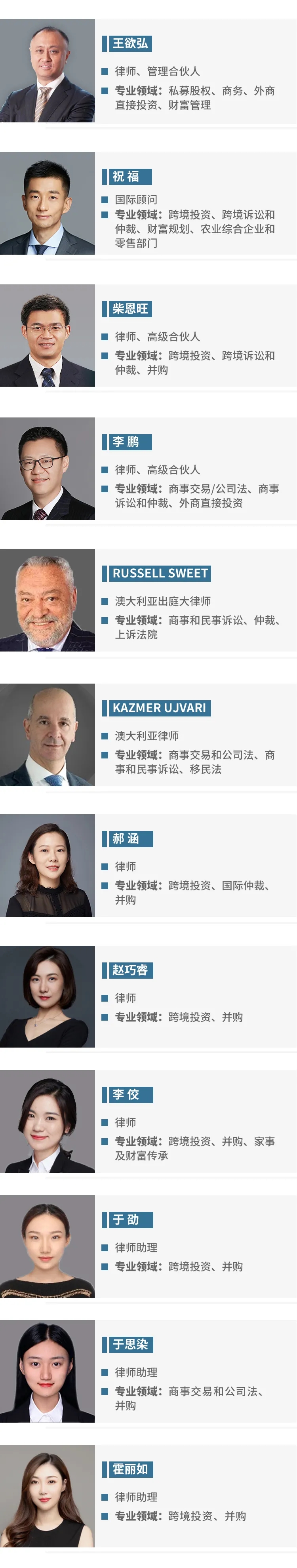

文康-君益诚涉澳法律团队

文康-君益诚律师联盟处理过诸多涉及澳大利亚的业务,在此基础上联盟成立了澳洲业务团队,团队成员包括多位能以英语为熟练工作语言的中国律师以及澳大利亚注册律师。

澳洲业务团队可为文康-君益诚联盟客户提供与中国-澳大利亚有关的投资、贸易、移民、跨国婚姻、诉讼等全方位、一站式的商业和法律服务。

Whether you are seeking to establish a local Australian subsidiary or acquiring an interest in an Australian company or asset, Wincon – JYC Australia Legal Team provides an integrated end to end solution to Chinese investors.

Our experience comes from a history of working with Chinese and Australian multinationals engaged in bilateral trade and cross border investments.

团队介绍

专栏文章

-

婚姻家事财富管理

家庭财富保护计划中使用全权信托有关的实务问题

文康涉澳法律团队2020-11-04 -

走进澳洲

专业解读“澳洲动产抵押权益登记署”

文康涉澳法律团队2020-09-24 -

走进澳洲

在澳大利亚购买房产:考虑因素和保护措施(下)

文康涉澳法律团队2020-08-21 -

走进澳洲

在澳大利亚购买房产:考虑因素和保护措施在澳大利亚购买房产:考虑因素和保护措施

文康涉澳法律团队2020-08-05 -

走进澳洲

遗产规划和财富保值计划的实际价值

涉澳法律团队2020-06-30 -

走进澳洲

澳大利亚公司的董事职务

文康涉澳法律团队2020-06-17 -

走进澳洲

董事职责与非法凤凰活动

本文为澳大利亚公司法系列文章。我们在过去的文章中详细探讨了董事的职责和义务以及自愿接管制度的流程。阅读本文需熟悉前述文章中讨论过的问题。2020-06-01 -

走进澳洲

澳大利亚的股东诉讼(下)

Shareholder litigation in Australia2020-05-12