前言

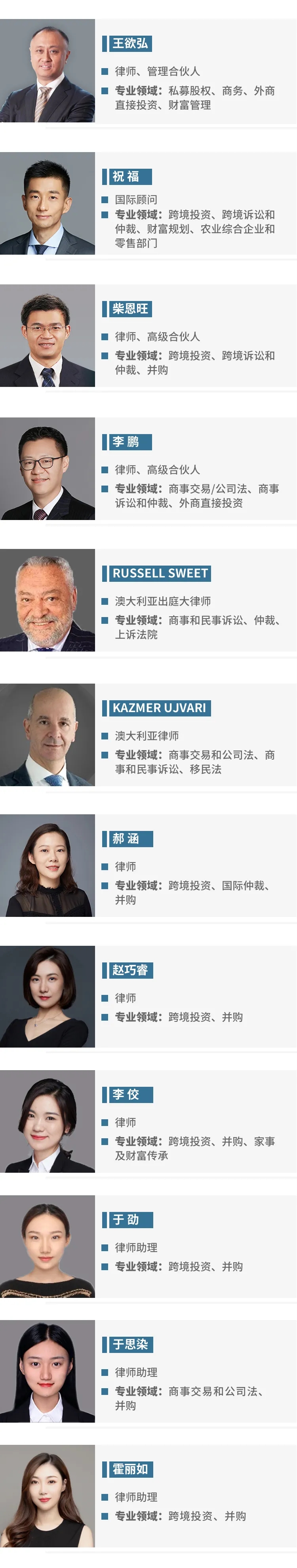

文康君益诚律师联盟的澳洲业务团队包括多位能以英语为熟练工作语言的中国律师以及澳大利亚注册律师,其中王欲弘律师在中澳法律、投资、贸易、移民等业务领域深耕多年。团队国际法律顾问祝福律师拥有澳洲律师牌照近十年,作为在澳大利亚长大的华人,熟悉中澳两国文化,处理了大量中澳跨境法律事务,经验丰富。

澳洲业务团队可为客户提供与中国-澳大利亚有关的投资、贸易、移民、跨国婚姻、诉讼等全方位、一站式的商业和法律服务。

动产抵押权益登记署

在我们的系列文章中,我们介绍了澳大利亚托伦斯产权制度、私人间按揭的合理使用以及此类担保形式对公司管理及清算的影响。

本文的重点是向读者介绍澳大利亚法律框架中其他重要的登记性权益,即PPSA中定义的权益。本文旨在为读者提供与澳大利亚实体之间进行贸易、收购或投资时保护自身权益的必要知识。

Our series we have introduced the Australian Torrens title system, the proper use of mortgages between private individuals, and the effect of such securitisation on the administration and liquidation of companies.

The focus of this article is to introduce readers to the other main registerable interest under the Australian legal framework, being those as defined under the PPSA. The article intends to provide readers with the required knowledge to protect themselves when engaging in trade, acquisitions or investments with an Australian entity.

一、什么是PPSA?

《动产担保法案》(PPSA)是约束所有与动产担保权益相关的法律。在此情况下,动产不仅指自然人拥有的有形财产,实际上也适用于除土地、构筑物和地上定着物以外几乎所有的财产。其中包括货物、机动车、飞机、船只、知识产权(著作权、专利和外观设计)、银行账户和债务/应收账款、股票和其他金融财产,甚至是个人的商用授权。

但是,PPSA不适用于州、领地或联邦政府授予土地、权利及权益有关的授权,或者法律明确规定不包含于PPSA中的财产。

显然,PPSA的重要概念是对“设立”于“动产”之上“担保权益”的“公示”,以及“登记”行为设立的“优先(受偿)权”。

The Personal Property Securities Act (PPSA) is the legislation that governs everything about security interests in personal property. Personal property in this context does not solely refer to tangible property held by a natural person, but in fact applies to almost all property other than land, buildings and fixtures to land. This includes goods, motor vehicles, planes, boats, intellectual property (copyright, patents, and designs), bank accounts and debts/receivables, shares and other financial property, and even private commercial licences.

The PPSA does not how ever apply to licenses pertaining to land, or rights and entitlements that is granted by the state, territory or commonwealth government, or those which have been expressly declared by legislation to not be included in the PPSA.

Evidently, the important concepts of a PPSA is the “perfection” of “security interests” “attached” to “personal property” and its “registration” to establish “priority”.

二、PPSA的目的

PPSA的目的是设立一项担保权益登记制度。该制度与托伦斯产权制度的土地所有权十分类似,该制度对公众开放、任何人均可查询,并为其设立、优先(受偿)顺序、灭失和此类权益的强制执行制定了明确的规定。

担保权益是一项动产“权益”,其可以单纯地视为合同权利,而不必是一项财产权益。

PPSA(第12条第2款)将以下交易类型明确列为担保权益:

对于那些从事贸易的客户来说,对出口至澳大利亚的商品进行抵押权益登记非常重要,而对于从事贷款和投资的客户来说,有针对性地使用固定押记和浮动押记、动产抵押以及有条件的销售协议(将大有益处)。

The purpose of the PPSA is to create a system for the registration of security interests. This system, much like Torrens System land title, is open to the public, searchable by anyone and creates clear rules for the creation, prioritisation, extinguishment, and enforcement of such interests.

A security interest is an "interest" in personal property which could simply be a contractual right and does not need to be a proprietary interest.

The following types of transactions are specifically listed in the PPSA (section12(2)) as being security interests:

• a fixed charge

• a floating charge

• a chattel mortgage (e.g.a share mortgage)

• a conditional sale agreement (including an agreement to sell subject to retention of title)

• a hire purchase agreement

• a pledge

• a trust receipt

• a consignment (whether or not a commercial consignment)

• a lease of goods

• an assignment

• a transfer of title

• a flawed asset arrangement

For those who engage in trade, the ability to register your secured interest over goods exported to Australia is of great important, whilst for those who engage in lending and investments, fixed and floating charges, chattel mortgages, conditional sale agreements are of particular use.

三、PPSA的主要概念是什么?

当抵押物上设立担保权益时,担保权益将在抵押人与担保权人间强制执行。抵押人通常是拥有抵押物(动产)的人。

当担保权益的抵押人对担保物享有权利或享有转让担保物权利的权力时,便产生了担保权益的设立;并且:

- 担保权益具有对价;或者

鉴于此,首先,抵押人必须对抵押物享有权利或享有将该权利转让给担保权人的权力。抵押人虽然无需拥有抵押物的所有权,但是要求抵押人不仅仅是占有财产(例如寄托)。这符合普通法“非有权者不能相授”的原则,或者更为宽松地理解为,一个人不能授予他人其并未拥有的东西。

其次,必须为担保权益赋予“对价”。在PPSA中,“对价”的定义更为广泛,包括先前的债务或责任,由此设立担保权益以确保偿还过去的债务或履行过去的义务。

最后,尽管必须赋予担保权益以对价,但PPSA适用于当事一方就另一方的债务或义务而赋予第三方担保权益的情况。

Attachment

A security interest will be enforceable as between the grantor and the secured party when the security interest attaches to the collateral. The Grantor is generally the person who owns the collateral (personal property).

Attachment occurs when the grantor of the security interest has rights in the collateral or the power to transfer rights in the collateral; and either:

- value is given for the security interest; or

- the grantor does an act by which the security interest arises.

Given this, first and foremost, a grantor must have rights in the collateral or a power to transfer these rights to the secured party. The grantor does not need to have ownership of the collateral but require more than a mere possession of the property (such as bailment). This is in line with the common law principle of nemo dat quod nonhabet, or to translate loosely, one cannot give away something he does not have.

Secondly, “value” must be given for the security interest. ‘Value’ in the context of the PPSA, is defined more broadly to include an antecedent debt or liability, where by a security interest can be granted to secure repayment of a past debt or the performance of a past obligation.

Lastly, although value must be given for the security interest, the PPSA is applicable in situations where third party security interests are granted by one party in respect of the debt or obligations of another.

为了使担保权益可由担保权人强制执行,则担保权益必须是“已公示的”。

公示担保权益的三种主要方法:

占有抵押物–通常适用于有形资产; 控制抵押物–通常适用于金融资产;和 在动产抵押权益登记署登记担保权益。

可以通过符合PPSA规定的测试占有或控制抵押物,或者通过在动产抵押权益登记署登记担保权益,以公示抵押权益。后者适用于大多数情况。

通常而言,除非担保权益得以公示,否则担保权人无法获得PPSA项下的最佳保障。通过“公示”以取得优先权(优先受偿)是必要的,并防止破产后抵押物归属于抵押人。

在某些情况下,通过登记以公示担保权益十分困难或不可行时,还有一种在短期内临时公示(担保权益)的形式。

对于登记的有效性有一系列正式的要求,包括PPSA和法规中规定的要求。

2009年《动产担保法案》(PPSA)的第5章规定了担保权益的登记程序。为登记担保权益,当事方必须登记与PPSA第12条中定义的“担保权益”相关的融资声明。

PPSR由登记官进行管理,并根据PPSA第150条第3款,(登记官)仅在以下情形负有登记担保权益的义务:

(a)申请采用经核准的表格;和

(b)已支付根据第190条确定的费用(如有);和

(c)令登记官不满意的申请是:

(i)琐碎、复杂或具有侵犯性的,或违反公共利益的;或

(ii)违反第151条(关于担保权益的意见)而作出的;和

(d)法规未禁止的登记。

PPSA第151条中规定了民事处罚条款,该条款可适用于当事人登记担保权益时,无法合理相信声明中描述为担保权人的人是或将成为与担保物有关的担保权人。

对PPSR提出异议的当事方应考虑登记是否符合正式的要求,并应考虑登记对其合同义务的相互影响,例如向担保权人提供保证。

For the security interest to be enforceable by the Secured Party, the security interest must be "perfected".

There are three main ways to perfect a Security Interest:

Possession of the Collateral – this is generally mostly applicable to tangible assets;

Control of the Collateral – this is generally mostly applicable to financial assets; and

Registration of the security interest on the PPS Register.

Perfection can be obtained by taking possession or control of the collateral in accordance with the tests laid down in the PPSA or by registering the security interest on the PPS Register. The latter of which is applicable in the majority of cases.

Typically, a secured party will not obtain the best available protection under the PPSA unless its security interest is perfected. It is necessary to “perfect” in order obtain priority and to prevent the collateral vesting in the grantor upon insolvency.

There is also a form of temporary perfection available for a short period in certain situations where it is difficult or impracticable to perfect a security interest by registration.

There are a range of formal requirements for a registration to be valid, including those set out in the PPSA and the regulations.

The process for registering a security interest is set out in chapter 5 of the Personal Property Securities Act 2009 (PPSA). To register a security interest, a party must register a financing statement with respect to a relevant ‘security interest’ as defined in section 12 of the PPSA.

The PPSR is administered by the Registrar who, under section 150(3), is only obliged to register a security interest if:

(a) the application is in the approved form; and

(b) the fee (if any) determined under section 190 has been paid; and

(c) the Registrar is not satisfied that the application is:

(i) frivolous, vexatious or offensive, or contrary to the public interest; or

(ii) made in contravention of section 151 (belief about security interest); and

(d) the registration would not be prohibited by the regulations.

There is a civil penalty provision in section 151 of the PPSA which may apply where aparty registers a security interest without a reasonable belief that the person described in the statement as the secured party is, or will become, a secured party in relation to the collateral (other than by virtue of the registration itself).

A party seeking to challenge a PPSR registration should consider if the registration is compliant with the formal requirements, and should also consider the interplay with their contractual obligation such as any warranties provided to the secured party.

四、PPSA的作用是什么

如同按揭,PPSA在个人或实体资不抵债(自然人在澳大利亚受破产法的约束)或在当事人违反担保协议条款时发挥作用。

清算人、管理人或破产托管人(当自然人宣布破产时被指定)在被指定时首要要做的是在PPSR中搜索相关登记。

之后,第一顺位的担保权人通常可以选择执行该担保并取得财产,或从出售财产中优先受偿支付款项。这也和托伦斯产权中登记的抵押贷款很类似。

在大多数清算人或破产托管人的任命中,无担保债权人要么将一无所获,要么将所获无几。回顾我们有关公司破产和管理的文章,有担保债权人的优先(受偿)权优先于公司资产。因此,如果您拟向个人或实体提供资金或商品,您优先考虑的事项是确保(担保人)承担义务。

Much like a mortgage, the PPSA comes into play when a person or entity becomes insolvent (natural persons are subject to bankruptcy laws in Australia) or when they default on the terms of a security agreement.

The first thing a liquidator, administrator or bankruptcy trustee (appointed if a natural person has been declared bankrupt) will do when appointed is search the PPSR for relevant registrations.

A first-ranking secured party can then generally choose whether to enforce their security and take the property or get priority of payment from the sale of the property. This once again is similar to a mortgage registered on Torrens Title.

In most appointments of liquidators or bankruptcy trustees, unsecured creditors will either receive nothing or very few cents in the dollar. Looking back at our article in relation to insolvency and administration of a company, a secured creditor has priority over the assets of the company. Therefore, if you propose to offer funds or goods to a person or entity, securing the obligation should be your priority.

五、结论

当您在澳大利亚开展业务时,了解如何保护您的投资至关重要。PPSR建立的优先权(优先受偿)和登记系统为“动产”提供了担保形式的手段。

自从PPSA颁布10年以来,PPSA的广泛运用和普及性证明了其有效性。然而,担保权人在考虑使用PPSA时,应首先确认法律文件确实产生了该法案所定义的“担保权益”。

由此,聘请一位了解PPSA的澳大利亚律师,从而及时确保您的权利得以有效落实十分重要。

When conducting business in Australia it is essential to understand how to protect your investment. The system of priority and registration created by the PPSR provides a means of securitisation for “personal property”.

Since its inception 10 years ago, its wide use and popularity is a testament to its effectiveness. However, secured parties when considering the use of the PPSA, should firstly ensure that the legal document actually give rise to a “security interest” as defined in the Act.

Given this, it is important to engage an Australian lawyer with knowledge of the PPSA to properly ensure the enforceability of your right.

文康-君益诚涉澳法律团队

无论您想在澳大利亚设立子公司还是收购澳大利亚公司股权或资产,文康-君益诚涉澳法律团队将为中国投资者提供最专业且全面的一站式服务。

团队介绍

专栏文章

-

婚姻家事财富管理

家庭财富保护计划中使用全权信托有关的实务问题

文康涉澳法律团队2020-11-04 -

走进澳洲

专业解读“澳洲动产抵押权益登记署”

文康涉澳法律团队2020-09-24 -

走进澳洲

在澳大利亚购买房产:考虑因素和保护措施(下)

文康涉澳法律团队2020-08-21 -

走进澳洲

在澳大利亚购买房产:考虑因素和保护措施在澳大利亚购买房产:考虑因素和保护措施

文康涉澳法律团队2020-08-05 -

走进澳洲

遗产规划和财富保值计划的实际价值

涉澳法律团队2020-06-30 -

走进澳洲

澳大利亚公司的董事职务

文康涉澳法律团队2020-06-17 -

走进澳洲

董事职责与非法凤凰活动

本文为澳大利亚公司法系列文章。我们在过去的文章中详细探讨了董事的职责和义务以及自愿接管制度的流程。阅读本文需熟悉前述文章中讨论过的问题。2020-06-01 -

走进澳洲

澳大利亚的股东诉讼(下)

Shareholder litigation in Australia2020-05-12