第二部分 可采用的结构

PART 2. Available Structures

本文第一部分向读者介绍了在澳大利亚购买房产时的不同考虑因素(上)。此部分我们将向读者阐述房产购买者在澳大利亚法律下可采用的一些结构。

Part 1 of this series sought to provide readers with an understanding of the different considerations when purchasing real estate in Australia. This part will introduce to our readers some of the structures which are available to purchasers under Australian law.

在安排购买时首先要知道,无论是房地产投资还是房地产开发,是属于业务的一部分还是其他任何活动,都没有放之四海而皆准的解决方案。

The first thing to note is that when structuring a purchase, whether it is for property investment, property development, as part of a business, or any other activity, there’s no one-size-fits-all solution.

因为每个人的个人情况都是不同的,需要考虑到这些差异,从而设计出一种与您的目标相符的结构。

This is especially so given thatindividual circumstances will differ, and it is these differences which needs to be taken into account when designing a structure that is for your purpose.

考虑到上述情况,在所需结构中,不同特征之间有时可能存在冲突。一个关于控制和所有权与资产保护的常见例子是——绝对控制和完全拥有某项资产是最符合预期的,以自己的名义持有资产是最直接的解决方案,但如果您是一家公司的董事,您的资产可能会受到公司法中董事职责规定的影响。因此,您最好不要直接持有该资产,或者仅对该资产拥有部分所有权。

Having regard to the above, conflicts willexist between the different features in a structure that is desired. A commonexample pertains to control and ownership versus assetprotection. Absolute control and complete ownership of an asset may bedesired and owning the property in your own name is the most direct solution, however if you are a director of a company, you may expose your property to thedirectors’ duties provisions in the Corporations Act. Given this, it may bebetter for you to not own the assets or at least only have partial ownership.

此外,根据您对房产的长期规划,在设计房产投资结构时,有以下几种选项可供您选择。

Also, depending on your long-term plans for the property, there may be several options open to you when it comes to structuring your property investment.

公司在法律上是一个独立的法人实体。因此,如果一个个人成立一家公司来购买投资性房产,则该个人并不是此房产的合法所有权人。这样虽然该个人不能完全拥有此房产,但会保护财产免受针对其个人的诉讼。

A company is a separate legal entity. Accordingly, if a company is set up to purchase a property, the individual isnot the legal owner of the property. This, whilst not affording completeownership to the individual, will however offer protection against legal claimsagainst an individual.

对于房地产开发商或长期投资者来说,公司结构是一个不错的选择。作为一个独立的法人实体,公司由指定的董事经营,由股东所有。在这种结构下,财产和按揭将与负债一起归属在公司名下。

A company structure is a good option for property developers or those who sees their investment as long term. As a separate legal entity, thecompany is run by the appointed directors and owned by share holders. Under this structure, the property and mortgage would be under the company name, along with the liabilities.

因此,在公司结构下,会得到更多的资产保护。然而,如果您不打算长期持有财产,为建立和维护公司结构所花费的时间和成本可能并不值得。

Giventhis, increased asset protection is gained under a company structure. If however, your intention is not to hold the properties long term, a company structure maynot be worth the time and cost to establish and maintain.

Trust (unit,discretionary)

信托结构是房地产投资者的热门选择。房地产投资者最常用的信托结构是家庭信托或单位信托。

Truststructures are a popular option amongst property investors. The most common trust structures used by property investorsare family trusts or unit trusts.

与公司结构类似,单位信托提供的是明确的收益,而且您从财产中获得的利润将与您在信托中的所有权相同。对于在非相关方或非家族性质的当事方之间进行的房地产投资而言,单位信托是一个不错的选择。

Similar to a company structure, a unit trust gives you a defined interest in the trust, and your profitfrom the property will be the same as your ownership within the trust. Unit trusts can be a good option for propertyinvestment between unrelated, or non-familial, parties.

家族信托没有明确的单位持有人,因其提供了灵活性和资产保护功能而可能成为首选。

Afamily trust doesn’t have defined unit holders, and may be preferred as it provides flexibilityand asset protection.

然而,需要注意的是,信托结构的复杂性可能会影响您的借款能力。

However, one thing to note is that the complexity of your trust structure may impact howmuch you can borrow.

一般而言,信托投资有一些明显的优点和缺点。

Generally speaking, there are some significant advantagesand disadvantages associated with buying in a trust.

其中的一个优点是,它为借款人提供了一定程度的资产保护。如果任何受益人破产或出现财务问题,信托内的资产通常会受到法律保护而不被用于清偿。

One such advantage is that it provides the borrower with a certain level of asset protection. Shouldany beneficiary become bankrupt or experience financialtrouble, assets which are held in the trust are usually protected against legalclaims.

监管信托的法规比监管公司的法规要少得多,而且信托单位通常是容易转让和回购的。

Thereare also much fewer regulations governing trusts than companies, and units cangenerally be easily transferred and re-acquired.

如上所述,公司是一个独立的法律实体,信托是一种法律关系。而合伙是一种合同安排,是两个或两个以上的合伙人基于合同约定的共同目标而从事经营。

As per above, acompany is a separate legal entity, whilst a trust is a legal relationship, a partnership however is a contractual arrangement underwhich at least two parties carry on a business with a common purpose.

值得注意的是,普通法合伙企业的每个合伙人都对合伙企业的债务承担连带责任。因此,如果其中一名合伙人以合伙企业的名义所做出的行为被提起诉讼,合伙人的个人资产将面临风险。

Itis important to note that each partner of a common law partnership is jointlyand severally liable to the liabilities of the partnership. As such, the personal assets of the partners can beexposed to risk if any partner is sued for an act which they conducted in thename of the partnership.

如果您对自己的房地产投资设有截止期限,合资企业可能是一个不错的选择。这种结构在开发项目中更为常见。在合资企业中,各方分享收益,而不仅仅是利润。

Ajoint venture can be a good optionif you have an end datefor your property investment. This structure ismore common for development projects. This is as in ajoint venture the parties share in the proceeds and not just the profits.

例如,各方拥有相邻地块的所有权,被分享的收益则是在这块土地上所建造的房产。

An example could be thatthe parties owns adjacent blocks of land, and the proceeds will be the propertythat is built on the land which is to be shared.

Individual (tenants in common equalor unequal shares; joint tenancy)

最简单的财产所有权结构是作为个人拥有财产。这意味着您以自己的名义购买和登记房产。

The simplest ownership structure for a property is owningthe property as an individual person. This essentially means that the property ispurchased and registered in your name.

不利的一面是,如果您被起诉,以您的名义所购买的房产不能受到资产保护。

On the downside, buying a property in your name doesn’t offer asset protection if you are personallysued.

以个人名义拥有财产包括与伴侣或配偶一起购买房产。在这种情况下,贷款文件和所有权证书上常会同时记载二人的名字。个人购买的好处是贷款过程简单。但不利的是,由于它不提供任何资产保护,如果您被起诉,则将对诉讼结果承担责任。

Owning property as an individual willinclude purchasing the property with a partner or aspouse. In such situations, it is common for both names to appear on theloan documents and title deeds. The benefits of purchasingas an individual is that the loan process is simple.Unfortunately, as it does not offer any asset protection, if you were to besued, you would be liable for the outcome.

这也意味着,任何正在起诉您的人,无论是在您的房产中受伤的房客还是您的商业伙伴,都可以危及您名下的资产或您以共有方式所持有的任何财产份额。

Thisalso means that anyone who is suing you, from a tenant injured in your propertyto a business associate, can attack the assets you hold in your name or yourshare of whatever is held in joint names.

Joint tenants and tenants in common

当各方作为共有产权共有人而拥有房产时,这意味着:

Whenparties own property as joint tenants, it will mean that:

- all joint tenants haveequal ownership and interest in the property; and

- a right of survivorship willexist.

生存者取得权指的是,如果共有人中有一方过世,房产将自动转移到依然在世的其他共有人名下。无论死者的遗嘱中是否有任何相反的意愿,均应适用生存者取得权。因此,在准备遗嘱和财产计划时,考虑财产所有的方式是很重要的。

Thisright of survivorship means that if one of the joint tenants passes away, theproperty will automatically pass to the surviving joint tenant. This right ofsurvivorship will apply regardless of any contrary intentions in the deceased’swill. As such, it is important to consider the way a property is owned whenyour will or estate plan is prepared.

当各方作为联名产权共有人而拥有房产时,这意味着两方或多方以明确的比例共同拥有某项财产,且可按照自己的意愿处置该财产。每个共有人享有的份额可以是等额的,也可以是不等额的。

Whenparties own property as tenants in common it means that two or more peopleco-own a property in defined shares. These shares can be disposed ofindependent of the other person’s interests and can be owned in equal orunequal shares.

联名产权共有人可以出售他们在房产中的份额,或者在遗嘱中将其赠与他人。这意味着不存在生存者取得权。

Atenant in common can sell their shares in the property or give them away in awill. This means that there is no right of survivorship.

对于那些有即将再婚的成年子女的人,或者为购买房产出资金额相差悬殊的人而言,联名产权所有权是常见的。这种所有权形式也适用于一起购买房产的投资者。

Ownershipas tenants in common is usual for people with adult children who are enteringsecond marriages, or for people who are contributing very different amountstowards the purchase of a property. This form of ownership can also be utilisedfor investors who are buying properties together.

Individualpurchased under another’s name

完全不推荐这种方式。在澳大利亚,若要达到同样的效果,还有更安全的方法。

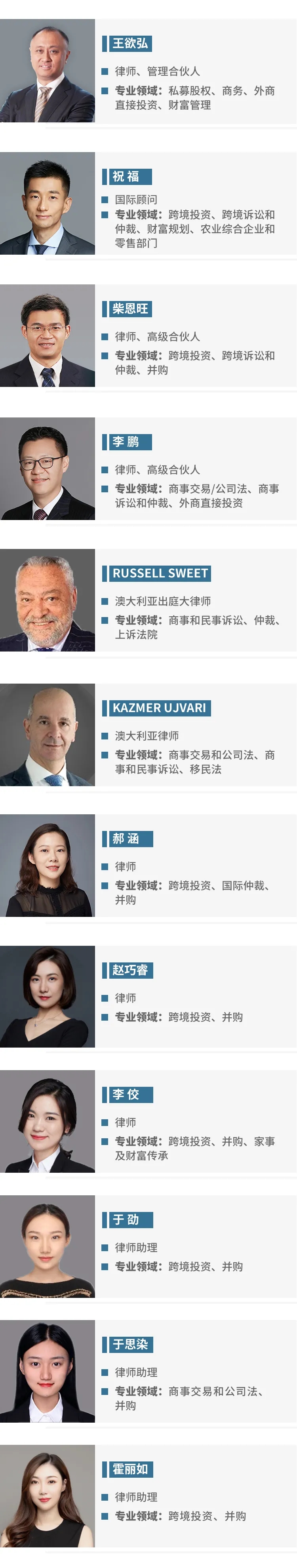

This is not recommended at all. There are much moresecure ways of achieving the same result in Australia.文康-君益诚律师联盟处理过诸多涉及澳大利亚的业务,在此基础上联盟成立了澳洲业务团队,团队成员包括多位能以英语为熟练工作语言的中国律师以及澳大利亚注册律师。

澳洲业务团队可为文康-君益诚联盟客户提供与中国-澳大利亚有关的投资、贸易、移民、跨国婚姻、诉讼等全方位、一站式的商业和法律服务。

无论您想在澳大利亚设立子公司还是收购澳大利亚公司股权或资产,文康-君益诚涉澳法律团队将为中国投资者提供最专业且全面的一站式服务。

通过与从事双边贸易和跨境投资的中澳跨国公司长期合作,我们拥有丰富的法律服务经验。

Whether you are seeking to establish a local Australian subsidiary or acquiring an interest in an Australian company or asset, Wincon – JYC Australia Legal Team provides an integrated end to end solution to Chinese investors.

Our experience comes from a history of working with Chinese and Australian multinationals engaged in bilateral trade and cross border investments.